Ireland’s Most Flexible Business Loan

If you’re an SME in Ireland, sole trader, or partnership business, you can choose a variable/flexible business loan with repayment terms to suit you – with GRID Finance.

In Ireland today, small & medium enterprises make up more than 90% of Ireland’s active economy. Many individuals & institutions, both micro and macro, depend on the success of SMEs for sustenance and prosperity. However, many people do not realise just how important and influential these businesses are in our daily lives.

However, the main reason for this post is to discuss the Importance of Variable/flexible Loans for small and medium sized businesses.

Why You Need a Flexible Repayment Loan

Flexible loans are designed to help small and medium sized business owners. GRID Finance has a very comprehensive loan repayment system that allows you to repay your loans according to your current business performance. The following are the advantages of a Flexible Business loan:

- Petty Cash is always available

- Lower interest rate compared to other loans

- Loan repayment process is Flexible

- Minimal documents are required.

- Short term Cash is Always Readily Available.

Every firm need funds from time to time to operate. Many times, a business may not make enough sales or profits to cover its fixed and variable costs in the short term. When this happens, flexible loans are very effective in such situations.

When a business takes on a Flexi loan, the amount of the loan gets deposited in their bank account, and interest is not paid until the money is withdrawn by the business. This ensures that more than enough cash is always available for immediate business needs. You can pay your workers, pay your rent and cover the cost of your invoices so that there is no interruption to your current service.

Lower Interest Rates Compared to Other Loans

Most banks and many other financial institutions provide fixed loans to their individual and SME customers. That much is common knowledge. SME loans however, are usually made up of many different incentives to get businesses to borrow. As a direct result, the interest rates repayable on such business loans is usually less. So take advantage of this.

Loan Repayment Process is Flexible

Flexible loans play an extremely crucial role in making business loans special. Why? Because they allow borrowers to repay based on how much they earn, and not a fixed amount.

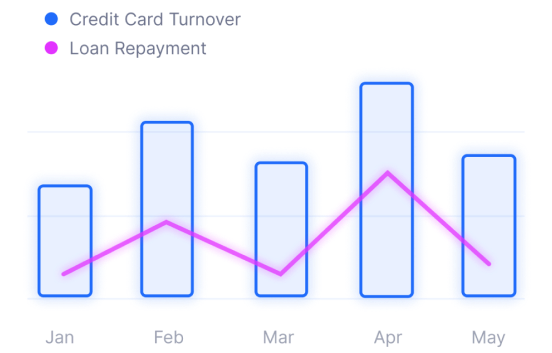

GRID Finance has an incredible system in place to guarantee this. Look at our simple chart below to get a good idea between or the relationship between your revenue and loan repayments with GRID Finance.

Minimum Documents Are Required

In order to apply for a flexible loan, customers do not have to provide as many documents as traditional face-to-face bank transactions. Sophisticated, yet seamless online applications have greatly reduced the need for middlemen when it comes to applying for business loans. The lack of a middleman also means that the client can contact the lender directly (GRID Finance), submit the necessary documents and also have a loan approved in under 24 hours!