Working Capital That Works with You

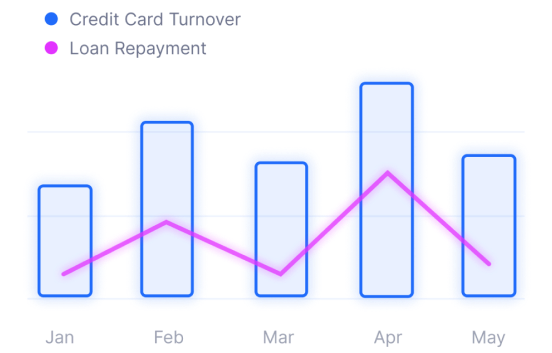

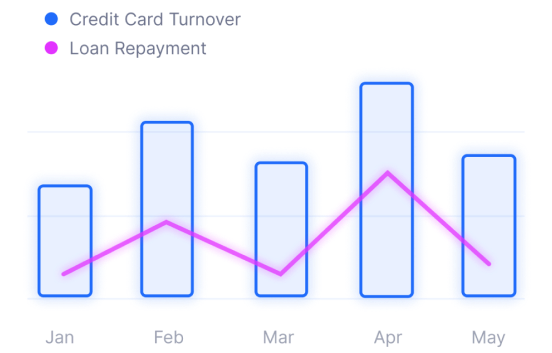

Borrow up to €500k and make a small daily repayment that adapts to your level of trading income.

In quieter months, repay less – supporting you when it matters most.

Running a B2B business is complex – dealing with long payment cycles, fluctuating cash flow and the pressure to meet clients demands. Our flexible financing is tailored to fit your business, helping you bridge cash flow gaps, seize new opportunities and stay ahead in a competitive market.

Sarah has a company which sells office furniture to other businesses. She receives payments from her customers by bank transfer usually within 30 days of invoicing them. Her daily repayments adapt to her income so it is aligned to how she is performing.

In quieter months, repay less – supporting you when it matters most.

You can be up and running again within 48 hours. Our repeatable funding process ensures a seamless experience, so you can focus on what matters most – growing your business.

Your path to growth and success becomes more achievable with affordable financing. So, you can look forward to:

Manage your finances more effectively with flexible repayment terms.

Avoid unnecessary pressure with daily repayments aligned to your business’s performance.

Flexible loans accelerate business expansion.